The fund’s investment structure is that of a “fund of funds” portfolio which seeks to provide investors with a diversified investment portfolio consisting of UCITS compliant funds or “collectives” from across the global investment universe. Collectives invested in within the fund can include unit trusts, mutual funds and exchange traded funds (ETFs) whose managers aim to outperform their respective markets. Asset classes you could find in this portfolio are equities, government bonds, corporate bonds, multi-asset, alternatives, and cash.

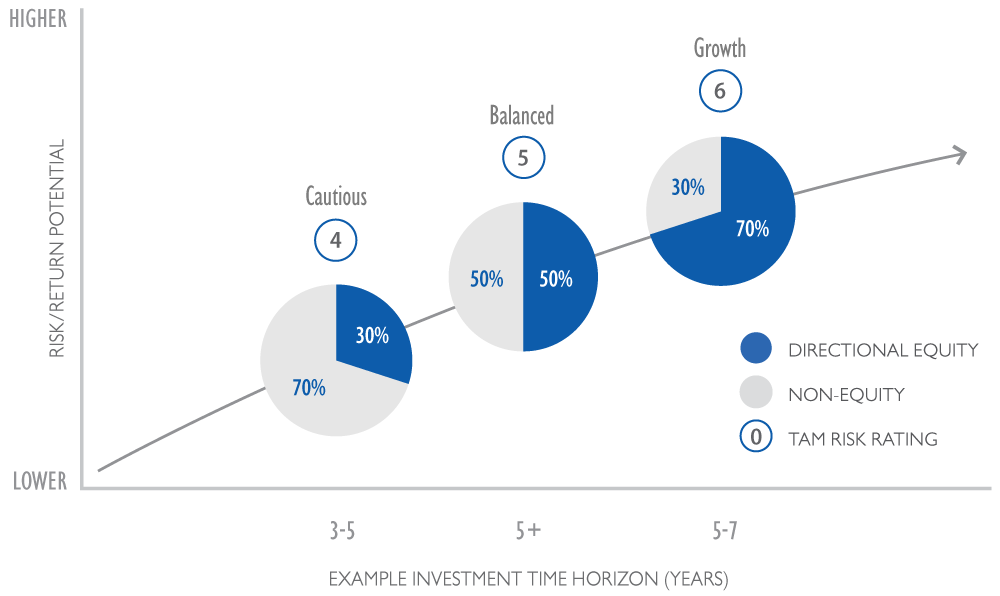

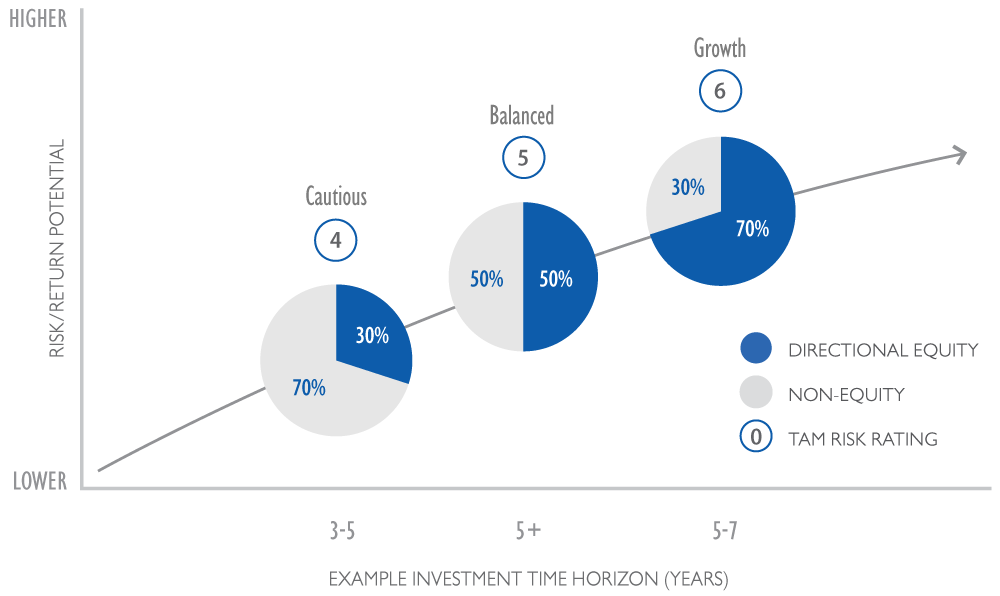

Clients can select a fund that most closely reflects their investment return objectives and attitude to risk. We offer three risk-graded fund options, ranging from lower risk bond-based returns, to higher risk equity-based returns.

The diagram is for illustrative purposes only. The value of investments, and the income from them, may go down as well as up and may fall below the amount initially invested. Weightings may deviate from these levels at the Investment Team's discretion whilst staying within specific guidelines, so the above asset allocation is intended as a guide only.

Cautious

This fund seeks to generate modest capital growth over the short to medium term (3 to 5 years or more) by employing a more cautious investment strategy. The fund will typically comprise 30% equity and 70% non-equity - though weightings may deviate within set parameters, allowing our managers to react to market conditions.

Balanced

This fund seeks to generate capital growth over the medium term (5 years or more), with the aim of riding out short-term fluctuations in value. The fund will typically comprise 50% equity and 50% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Growth

This fund seeks to generate higher capital growth over the medium to long term (5 to 7 years or more) by employing a more dynamic investment strategy. The fund will typically comprise 70% equity and 30% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.